7. · Please see portal:blogger.com: Brian Byrne 9. 5. · Margins are required when options are sold/written. When a naked option is written the margin is the greater of: I A total of % of the proceeds of the sale plus 20 % of the underlying share price less the amount (if any) by which the option is out of the money I A total of % of the proceeds of the sale plus 10% of the underlying share blogger.com Size: KB · The RED payoff function for Binary Options is without the price being considered from seller's perspective. If the underlying stock price remains below $50, then seller looses nothing. But if it goes above $50, he has to pay $40 to the buyer. The $50 is

Binary Option | Payoff Formula | Example

A binary option also known as binary option payoff option is a financial contract that entitles its holder to a fixed payoff when the event triggering the payoff occurs or zero payoff when no such event occurs. Possible payoff of a traditional option ranges from zero to some upper limit or infinity and it depends on the actual difference between the exercise price and the price of the underlying asset.

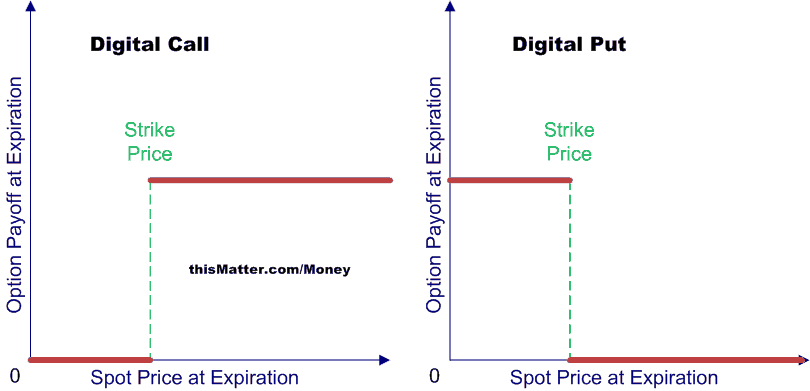

Payoff of a binary option on the other hand, is just a fixed amount which is not affected by the difference between the exercise price and the price of the underlying asset. A binary option depends on the relationship between the exercise price and the price of the underlying asset only to determine whether the payoff will occur or not. It is also called digital option because its payoff is just like binary signals: i, binary option payoff. A binary call option pays 1 unit when the price of the underlying asset is greater than or equal binary option payoff the exercise price and zero when it is otherwise.

This is expressed by the following formula:. A binary option payoff is exactly the binary option payoff of a binary call option, as expressed by the following formula:. Keita Yoshihara is a trader at Foundation Investments. What if the SET is 1,? In the second scenario where SET is 1, payoff will be zero because the condition required to trigger payoff is not fulfilled i.

the SET 1, is not greater than or equal to binary option payoff exercise price of 1, In this scenario Keita will have to let the options expire wothless. by Obaidullah Jan, ACA, CFA and last modified on Sep 10, Studying for CFA ® Program? Access notes and question bank for CFA ® Level 1 authored by me at AlphaBetaPrep. com is a free educational website; of students, by students, and for students, binary option payoff.

You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, binary option payoff, your feedback is highly valuable.

Let's connect! Finance Toggle Dropdown Accounting Economics Audit Management Computers Statistics. In this chapter tap to expand Hedging Interest Rate Swaps Credit Default Swaps Hedge Ratio Binomial Option Pricing Model Duration-matching Futures Contract Put Option Black-Scholes Model Forward Contract Covered Call Naked Call Money Market Hedge American Option European Option Asian Option Binary Option At the Money Option Call Option In the Money Option Out of the Money Option Exercise Price Protective Put.

Definition Formula Example. Related Topics American Option Asian Option European Option Put Option Call Option. Join Discussions All Chapters in Finance. Current Chapter. Hedging Interest Rate Swaps Credit Default Swaps Hedge Ratio Binomial Option Pricing Model Duration-matching Futures Contract Put Option Black-Scholes Model Forward Contract Covered Call Naked Call Money Market Hedge American Option European Option Asian Option Binary Option At the Money Option Call Option In the Money Option Out of the Money Option Exercise Price Protective Put.

About Authors Contact Privacy Disclaimer. Follow Facebook LinkedIn Twitter. Copyright © XPLAIND, binary option payoff.

Exotic options: binary (aka, digital) option (FRM T3-44)

, time: 11:27Binary Options vs. Options: What is the Difference?

2. · Delta of a digital (or binary) option is like the normal distribution probability function, approaching 0 at far OTM / ITM conditions and representing a very high peak at ATM. The peak at ATM approaches infinity as we approach the maturity. This is never like a vanilla option since the payoff never simulates the payoff of the underlying 9. 9. · A binary option (also known as an all-or-nothing or digital option) is an option where the payoff is either some amount or nothing at all. The payoff is, usually, a fixed amount of cash or the value of the asset. For our simulation, we're going to look at cash-or-nothing binary options · The RED payoff function for Binary Options is without the price being considered from seller's perspective. If the underlying stock price remains below $50, then seller looses nothing. But if it goes above $50, he has to pay $40 to the buyer. The $50 is

No comments:

Post a Comment