4. 6. · Whereas in case of Binary Options, you have to wait for the expiry and once a position is opened, you have to wait for either of the outcomes The key way that this binary option differs from a vanilla option is that your payout is going to be determined by what the strike price is in comparison to your buy price at the expiration date 1. 6. · The main difference between the binary and the vanilla options is the fixed outcome of the former: you get a fixed ROI on the contract’s price if option ends in-the-money. This means that binary options have a fixed gain in addition to a fixed loss, which intrinsic to vanilla options 9. · The biggest feature of binary options is the fact that the payout is known in advance while with plain vanilla options the return will fluctuate during the life of the option. For the trader this means tha binary options are simples because they know in Estimated Reading Time: 3 mins

Binary Options vs. Vanilla Options in Forex Trading

Speculation trading stayed within the elite preserve of professional and institutional investors and was accomplished by over-the-counter dealings by the use of minimum regulatory control. The first noteworthy event to transform the image of options trading occurred in when the Chicago Board of Trade designed the first supervised options trading platform by forming the Chicago Board Options Exchange CBOE.

The CBOE was the groundbreaking body which still functions these days as one of the biggest options trading environment in the world. A Vanilla Option is a financial instrument that gives the holder the right, but not the obligation, vanilla options vs binary options, to buy or sell an underlying asset at a predetermined price, within a given time frame. A vanilla option is a normal Call or Put option that has standardized terms and no special or unusual features.

In vanilla options, an investor pays per contract vanilla options vs binary options. Subsequently the investor will profit or lose an amount depending on the number of points difference between the expiry level and the strike price.

Exotic Option — Any option with a complex structure or payoff calculation. Time Value — The additional amount that traders are willing to pay for an option. American Option — Option that can be exercised any time before the expiration date. European Option — Option that can be exercised only on the expiration date.

Find More definitions of Binary Options Trading on our Glossary Here. He would have no obligation to buy the stock, only the right to do so till the expiration date. So if the stock price at expiration is above the exercise price by more than the paid price, the options trader will profit.

If the stock price at expiration is lower than the exercise price, he will let the call contract expire worthless and will only lose the amount of the premium or the paid amount. In a long put position, the investor expects the stock to fall. As the underlying security declines, the Put will increase in value. Purchasing a Put gives the investor the right to sell shares of stock at a set price called the strike price, vanilla options vs binary options. It is a bearish options strategy that involves short selling or writing call options.

When the stock falls below the strike price of the call options by expiration, the call options expire worthless and the entire premium from sale is earned. When you short sell, you are selling a security without actually owning it, in a hope that you can buy it later when the price falls and repay your loan and exit altogether.

If the options trader is bullish and believes the market will risehe can sell or short puts. Sellers do have obligations though. A put seller has the obligation to buy shares per option of the underlying stock at the put strike price, vanilla options vs binary options.

The profit equals the credit received from the sale of the put. Put sellers often prefer options with less time left until expiration because they want a put to expire worthless.

So in this way, the seller keeps the entire premium. A short put is covered or offsetted by purchasing a put with the same strike price and expiration to close out the position. With the wide range of prices available, some will suffer from very low liquidity making trading difficult. Vanilla options trading most of the times though vanilla options vs binary options necessarily requires higher capital than trading other assets.

Hedging in options provides you the insurance on your shares or option positions and protects the value of you assets. Risk is limited to the option premium not when writing options for a security that is not already owned. Vanilla options vs binary options allow you to employ considerable leverage.

This is an advantage to dsciplined traders who know how to use leverage, vanilla options vs binary options. Provides a wide variety of strategies while trading options by taking use of market volatility and time decay.

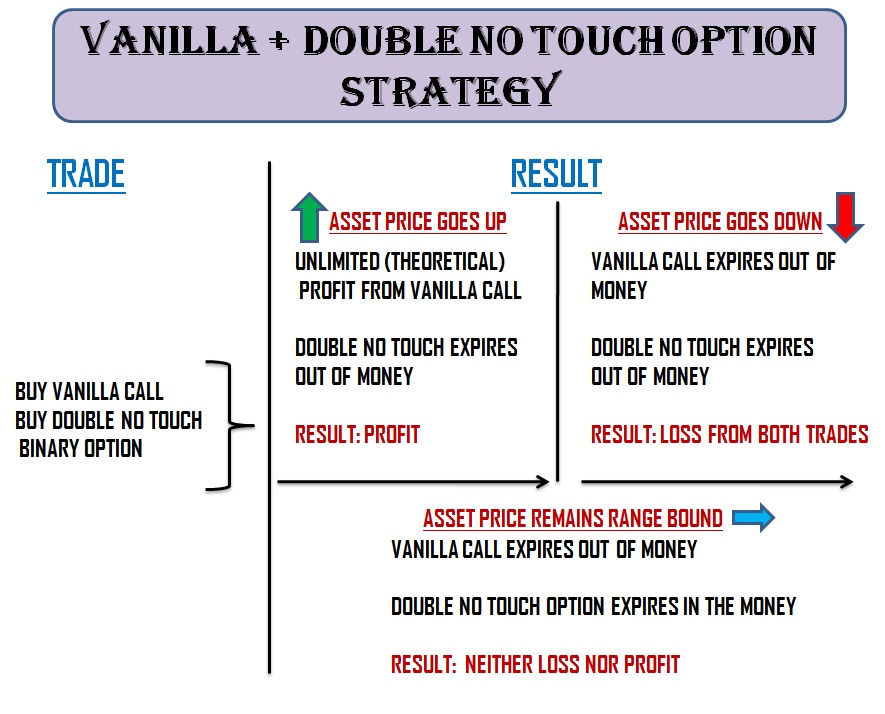

while Vanilla Options Require a relation of the strike price of an option and the underlying price in order to execute the option. In Binary Options payout is fixed ,in Vanilla vanilla options vs binary options payout is Dynamic, based on the underlying asset price. In Binary Options there are variety of expiration terms: end of day, hourly and even shorter expiration like 15 min binaries are available while in Vanilla Options expiration is once a month.

Generally speaking there are two schools of vanilla options vs binary options when it comes to binary options. The first group considers binaries to be an improvement on the standard, rather involved vanilla options; the second group considers binary options to be a form of gambling rather than a form of investment vanilla options vs binary options trading. It must be conceded that binary options are high risk, high return financial instruments and thus may risk and returns from binary options trading may resemble those associated with betting.

However, trading binary options is no different than many other forms of speculating on the financial markets such as vanilla options trading, futures trading and more and should thus not be considered anything other than financial investing.

Discuss on other Newbies issues with Ammad and our Binary Options Traders Community on the Forum! com Popular Reviews 24Option IQ Option Nadex HighLow Ayrex eToro BDSwiss Binary. com IG OptionRobot Bitcoin Code Tesler App Binary Robot Crypto Robot GreenFields Capital The Bitcoin Trader BinBot Pro The Crypto Genius, vanilla options vs binary options.

History of Options Trading 1. Long call 2. Long put: 3. Short call: 4. Short put: Difference between Binary and Vanilla Options:. All Rights Reserved. Home About Us Our Writers Disclaimer Contact Us. Please be noted that all information provided by ThatSucks. com are based on our experience and do not mean to offend or accuse any broker with illegal matters. The words Suck, Scam, etc are based on the fact that these articles are written in a satirical and exaggerated form and therefore sometimes disconnected from reality.

All information should be revised closely by readers and to be judged privately by each person. We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it, vanilla options vs binary options.

IQ Option - Binary VS Digital Options - More Risk More Profit Not

, time: 7:58Binary Options vs. Options: What is the Difference?

4. 6. · Whereas in case of Binary Options, you have to wait for the expiry and once a position is opened, you have to wait for either of the outcomes The key way that this binary option differs from a vanilla option is that your payout is going to be determined by what the strike price is in comparison to your buy price at the expiration date 5. 9. · Differences between Traditional/Vanilla Options and Binary options: In Binary Options, price movement is irrelevant, just the direction (above or below) while Vanilla Options require a relation of the strike price of an option and the underlying price in order to execute the blogger.comted Reading Time: 6 mins · how to trade gold binary options; Vanilla options vs binary options. Best binary option strategy Nadex trading course. The only thing that matters vanilla options vs binary options is the relationship of supply and demand on the stock exchange —whether traders are currently buying or interactive brokers bitcoin trading selling

No comments:

Post a Comment